Get a Business Essential Checking account from our parent company, Ameris Bank.

Learn MoreBusiness Essential Checking offers Online and Mobile banking, an Ameris Bank Visa debit card, NO minimum balance requirement and much more. Plus, there’s NO monthly service fee when you choose e-statements. Apply for an account online in just a few minutes!

Balboa Capital is a top-rated small business lender.

Getting small business funding can be difficult. A low credit score, cash flow problems, or lack of collateral can prevent you from getting the funding you need to take your company to the next level. That is where Balboa Capital, a division of Ameris Bank, comes in. We are a top-rated small business lender that is transforming small business lending.

Balboa Capital has several small business funding options to choose from, and applying for them is easy. Then, if your application is approved and you decide to move forward, one of our helpful account managers will contact you to discuss your options and answer any questions you have. It is small business funding made simple, and it is available right here, right now.

Big lending power.

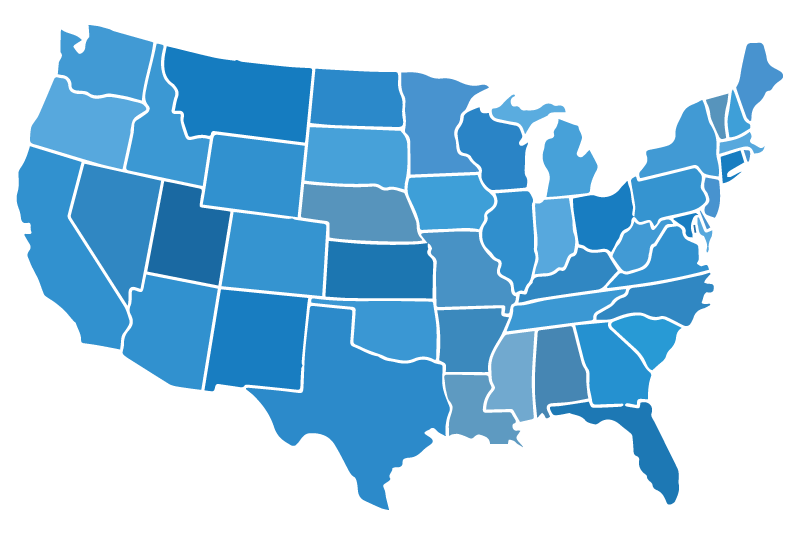

Our large lending capacity allows us to continue supporting small business owners like you who need growth capital. We help small businesses nationwide who need funding to finance equipment, technology, and vehicles and small business loans to cover the cost of expansion initiatives, inventory, and day-to-day operating expenses. We also offer SBA loans from $400,000 to $5 million nationwide.

- A division of Ameris Bank

- Over $7 billion funded

- Nationwide coverage

- 200+ employees

- Single point-of-contact

- Industry expertise

Small business funding in three simple steps.

Apply online for funding

You can apply online for any of the business funding products that we offer. We keep our applications simple and straightforward.

Get a credit decision

Our streamlined process speeds up the credit decision process. You will not wait long to see how much you may qualify for.

Receive your funds

If your application is approved and you decide to move forward, you will get your funds quickly. We have fast turnaround times.

Balboa Capital is trusted by tens of thousands.

Small business owners, equipment vendors, franchise owners, and middle-market executives nationwide look to Balboa Capital for growth capital.

Our commitment to fast, dependable funding and great service has helped us achieve an A+ rating with the Better Business Bureau®. We also have hundreds of five-star customer reviews online.

Reasons to choose Balboa Capital.

Bank-owned business lender

Over $8 billion funded nationwide

Simple, quick process

Mid-Year Tax Updates For Businesses

In July 2025, the Congress passed the budget reconciliation law, which introduced several general business provisions that may benefit business owners and the equipment finance industry as a whole.

In this Balboa Capital blog article, we will break down updates in the Section 179 tax deduction, first-year bonus depreciation, and the qualified business income (QBI) deduction.

By submitting this form, you agree to receive occasional emails from Balboa Capital that you can opt out of,

and you acknowledge you have read and agree to our Privacy Policy.